If you’re like most people, you have a love-hate relationship with money. You love some of the benefits it can provide you:

- A home

- Electricity

- Delicious food

- Nice clothes

- Internet

- Car

- Robot vacuum cleaner

- Your favorite armchair

- Vacations

…and much more.

In fact, for most of us – there’s a never-ending list of things we’d love to exchange for money if we could. With enough money, you can buy products that make life more convenient (and fun), experiences that have you smiling ear to ear, and you can even buy time – by outsourcing tasks you would normally need to do yourself.

But despite all these amazing benefits, money seems to have a dark side as well. Because of its power to incentivize us, it can lead people to:

- Work themselves into bad health

- Take crazy risks to acquire it

- Arguments & toxic relationships

- Commit heinous crimes

- Develop anxiety and fear

- Manipulate and de-humanize people for profit

- Start wars & economic conflicts

Because of the power money has over us, and what it leads some people to do, many of us shun it, see it as bad/evil, and develop a negative association with money. Some of this may even be at a subconscious level. And when you have a toxic relationship with money, you’ll tend not to give it the attention it needs.

Now, I’m not going to pitch you on why you should be “wealthy”. Who defines wealth anyway? Is it $1M, $10M or $1B? I can’t set your goals for you, but most of us would agree that achieving financial independence is a net positive outcome. And the good news is that financial independence actually can be defined once you know your lifestyle expenses. I see it as the point where you can sustain yourself indefinitely without any reliance on additional active income. You can read my article on F.I.R.E (financial independence, retire early) here.

And if you really think about it, even if you don’t like to “focus” on money too much, the best thing you could do is: make enough of it so you don’t have to worry about it anymore!

But to get there, the journey requires planning, measurement, and habit formation. As Peter Drucker, the productivity guru once said – “what gets measured, gets managed”.

Personally, I have found that statement to be incredibly true in every area of my life.

In this guide, I’m going to make a case for re-assessing your thoughts, beliefs, and habits around money. Then I’m going to lay the foundations for what I believe is an incredible system for managing your money and getting rich. Or should I say, ‘wealthy’? Despite sounding a little obnoxious, for some reason the word ‘rich’ just seems to have so much more “oomph” to it!

First, we need to lay some foundations.

Eradicating Misconceptions you Might Have About Money.

There are lots of misconceptions about money, and the role it plays in our modern monetary system. In order to build a strong foundation, we need to quickly get some basic ones out of the way…

Misconception: Thinking it’s all about how much you earn

You may have heard the old “it’s not how much you make, it’s how much you keep” saying before, and quickly ejected it from your mind, labelling it as ‘obvious’.

But despite knowing this, most people I talk to about building wealth still seem to use their income as their biggest excuse, but then quickly change the subject when it comes to how much they’re spending.

And while, unlike other financial writers, I don’t pretend like your income doesn’t matter (of course it does) – it doesn’t change the fact that what you keep matters much more. This is as basic as it gets, and later in this guide – I’ll show you how I set up a bulletproof banking system that makes it impossible to overspend, all without using a traditional ‘budget’.

Misconception: Thinking that ‘saving’ is enough

Due to inflation, saving money in a ‘high interest’ bank account is a waste of time. In fact, I call it running on a financial hamster wheel. If you earn 2% interest from your bank, and the average inflation rate is also 2%, your money won’t actually grow.

Now, don’t get me wrong – it’s still a great thing that you’re able to stash away some savings, but there’s a better way. It’s called investing. And it’s the only reliable path to wealth.

Misconception: Thinking willpower alone will get you there

Relying on your memory, willpower, discipline or any other finite human ability is a surefire way to fail with money. I’m sorry to say, it just doesn’t work long term. Why? Because as human beings, we’re emotional, moody, and inconsistent. We forget things, we get cravings, we feel tired, we slip up.

Instead, if you want to be financially in control, and rocket your net worth – you should rely on habits and systems.

That’s a theme you’ll notice in this guide – we want to take away as many daily decisions and actions from you as possible. The modern world is simply too overwhelming. Your willpower/discipline is like a battery – it’s finite. It will run out. So why waste that precious willpower on things that we can put on autopilot?

Soon, I’ll show you how to make your dollars move around like little robots, without lifting a finger. You’ll be making fewer decisions with your money, but be in far greater control!

Misconception: Thinking it needs to be complicated

You might, understandably so – assume that wealthy people have very complicated money set-ups. Hundreds of investments, bank accounts, and intricate financial systems.

And while that can be true, it doesn’t need to be. If you have businesses – yes – things can get a little complicated. However, if you are just managing your personal finances and investments – you’ll be shocked how simple of a setup you can get away with.

You don’t need to have 17 real estate properties, stock options, bonds, a billion ETFs (exchange-traded funds), 7 antique cars, and 4 rare Pokemon collectible cards to get wealthy. You can – but you don’t have to. Yes, diversification is important – but there’s no need to take it to extremes because it adds too much complexity. Particularly when you’re first getting started on your journey to financial independence. For most people, when they think about everything they ‘could’ do, they end up doing nothing.

Think of complexity as your Kryptonite!

We’ll also talk about financial minimalism in this guide, and why fewer moving parts is almost always a good thing. I actually stole this idea from business leaders, who even in behemoth companies realize that focusing on a minimum viable product/system/machine is always better. You should only add complexity to something when there is no other way around it. But never because it makes you feel clever!

Less moving parts means less decision-making, less willpower, less maintenance, less stress. You’ll see later on why this becomes critical. We want to create, as the Architect from the Matrix Reloaded calls it – a “harmony of mathematical precision“. Yes, I just quoted the Matrix in a finance article, what of it?

Personal Finance and Wealth Building: A Harmony of Mathematical Precision

Building wealth is like growing a strong tree. You’ve got the roots & trunk, branches, and leaves. Think of the roots & trunk as your system and infrastructure. People from the outside looking at your fruits (home, car, surging stock account, etc) won’t see any of it, but those are what hold everything together.

Your branches are the bank accounts, cards, investment accounts/brokers, retirement accounts, apps, spreadsheets, etc. These by themselves are meaningless. Anyone can open up a bank account, sign up for an app, make a spreadsheet etc. It’s the system, habits, and underlying infrastructure that makes all the difference.

The leaves are the investments, and from them – come the fruits (money).

The point is, that most people are only ever looking at the branches, leaves and the fruit of others. The ask questions like:

- “What kind of credit card do you use?”

- “What stock broker do you use?”

- “What stocks are you buying?”

- “Stocks or Crypto?”

While these are legitimate questions, it’s never where you should start. Experienced wealth builders look at someone else’s fruit and wonder what’s going on in at the root and trunk level.

How to Build Strong Financial Roots

I know you’re excited to get to the nitty-gritty of setting up your money machine. But before we get to that, a quick note on goals. You absolutely must have a target before you start this process. Read my article here, crunch your numbers, and decide on your goal. Our brain always needs something to latch on to. And when we talk about goals, of course – we’re referring to your net worth. You can review this yearly, so just set your number, and let’s move on!

The next thing you need to keep in mind, is that I can give you all the systems in the world, but it all comes down to execution. If you are doing this alone – you’re good to go. However if you have partner or family, and you’ve decided to share accounts/finances – you’ll all need to be on the same page. There’s simply no other way around it.

Now, in order to create strong roots – we need to set-up your “money machine”. This is a financial infrastructure that paves the path for everything we’re about to do.

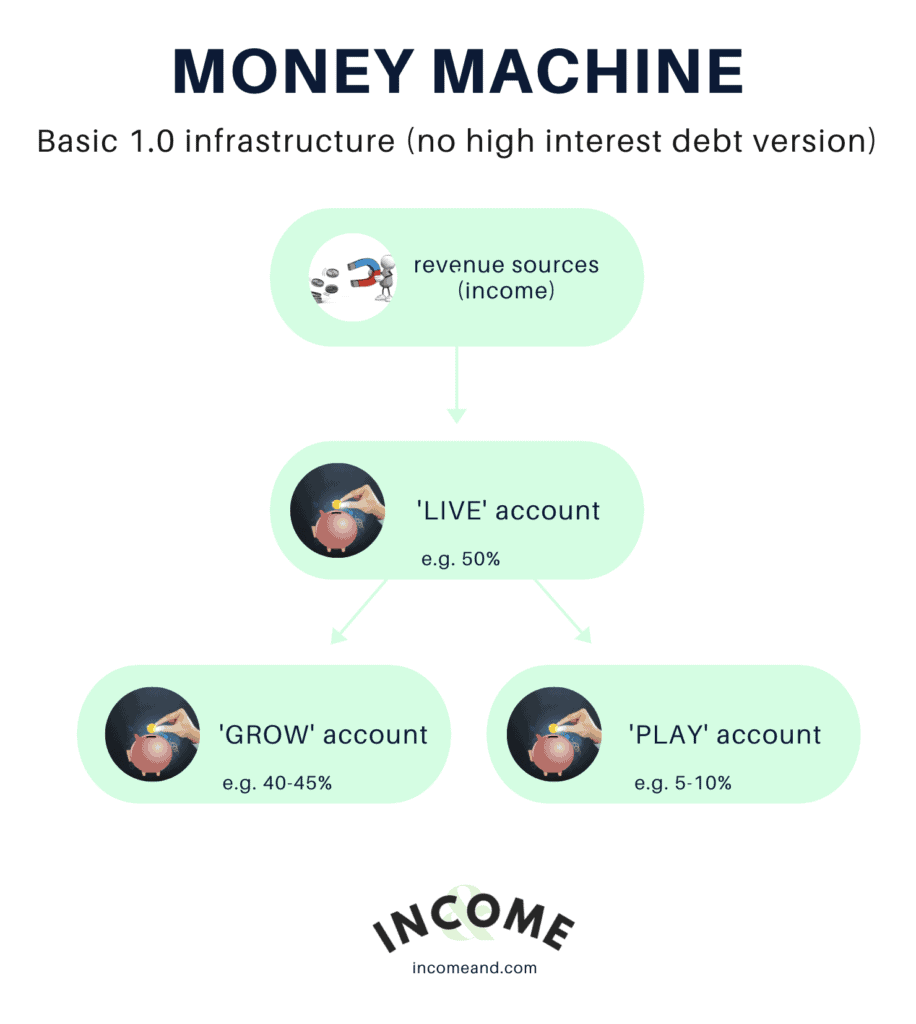

Basic 1.0 infrastructure (no high interest debt version)

The basic 1.0 version of my ‘money machine’ system, is extremely simple. It works like this:

You have 3 bank accounts, these are standard checking accounts (also called ‘transaction’ and ‘everyday’ accounts depending where you’re from).

LIVE: this account will be used for your essential expenses

GROW: this account will be used as part of your investing system

PLAY: this account will be used for non-essential expenses

All your income sources go into your ‘LIVE’ account. Once you’ve crunched your numbers, you should have your essential expenses and non-essential expenses calculated.

Your essential expenses are things like housing, utilities, food and essential transport.

Your non-essential expenses are things like netflix, eating out, buying gadgets, and travel.

If you’re very ambitious, you’ll notice there are guidelines in the chart above with percentages. If you can manage it, that would be a very good setup – 50% essential living expenses, 40-45% into your grow account and only 5-10% into your play account. You can re-work these numbers based on your goals, and how much you’re willing to sacrifice.

Obviously, the bigger the percentage going to the grow account, the faster you can achieve financial independence, as we’ll talk about soon.

Now, here’s the important part. We need to turn on automation. Call your bank and ask them to set up monthly automated transfers from your main account to your ‘GROW’ and ‘PLAY’ accounts. Or if you use internet banking (which you should be), then you can set this up yourself using their website or app. I usually would set the auto-transfers to occur on payday. So the same day your money hits your ‘LIVE’ account, the two transfers will automatically take place.

You should have two cards linked – for your LIVE and GROW accounts since you’ll actually be using these accounts to make payments. Then you would need to log in or call various companies billing you and change your card billing details accordingly.

Wherever possible, create auto-payments for your bills. Unless it’s for something you need to audit/check before paying. But for something like your internet connection, which for most of us, is a fixed fee – why waste time manually paying this each month? On a side note, I classify my internet as an essential expense (as part of utilities/bills).

Why does this work so well? Why set up different bank accounts? What about credit cards?

This is a basic financial infrastructure that works exceptionally well because it’s simple, automated, and has an in-built (automatic) budget. Since your non-essential expenses are automatically transferred to your PLAY account, you can only use what’s in there and no more. It becomes a total no-brainer. Can I afford to go to the cinema? Hmmm, let’s take a look at my PLAY account…

You can choose to spend all the money in your PLAY account each month, or let it accrue and make bigger PLAY purchases like a vacation or an expensive tech product.

In terms of credit cards, I have a different infrastructure which I’ll share in a future article, however – you really need to consider whether you should go that route. The basic system above will work better for most people, in my opinion.

Because it has in-built (automated) budgeting and control. You can’t do the same thing with a credit card. It really comes down to self-awareness. How much interest have you paid on your credit card in the last 24 months? How many impulse purchase decisions have you made?

If you don’t like the answers to these questions, you may be much better off with the basic version 1.0 structure above.

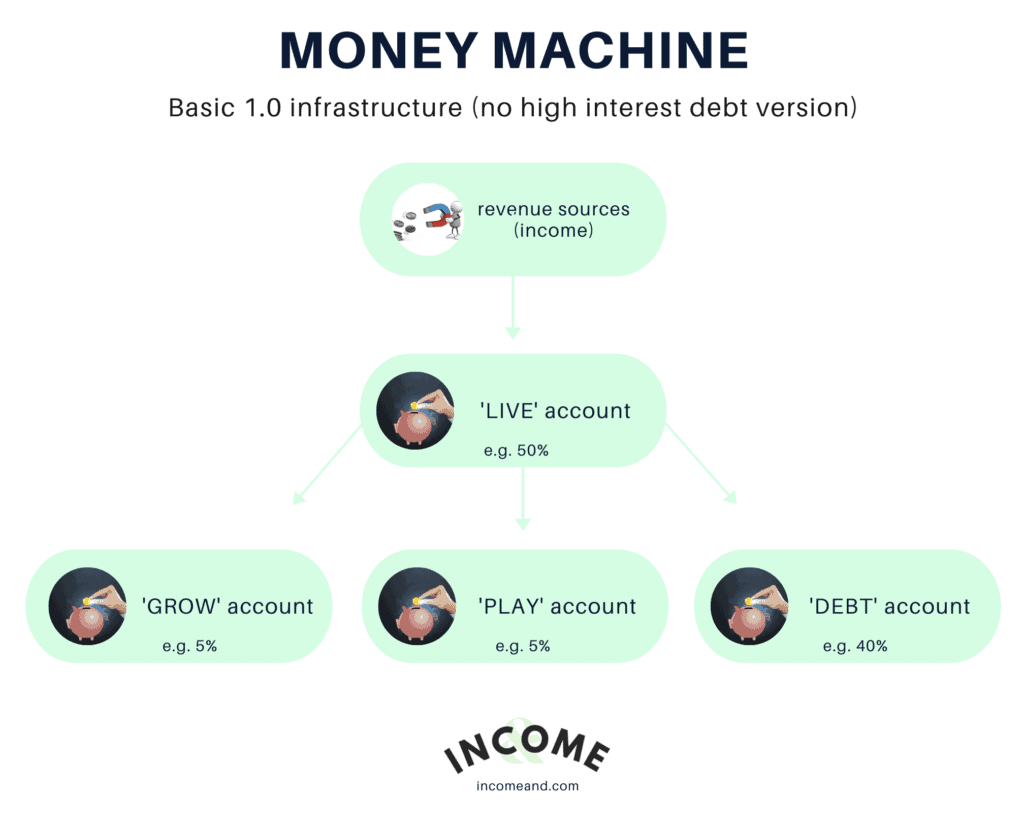

Now, let’s talk about high-interest debt. If you have very low amounts of high-interest debt (from credit cards, payday loans, etc) then just follow the set-up above and pay it off from your ‘LIVE’ account. However, if you have major high-interest debt, it can be a very good idea to create an extra account just for the purpose of eradicating that. Here’s how it would look…

Basic 1.0 infrastructure (with high interest debt version)

In this setup, you allocate a set amount for your high-interest debt every month. The reason for this is to prioritize it. High-interest debt is anything above 15%, which would include credit cards, payday loans, and other types of nasty debt. We need to crush this debt ASAP because the interest rate is higher than the rate of return you’ll usually get with passive investing. This is a big problem. With passive investing, you may only be growing your funds by 8% (average). So if you’re losing 15% or more through nasty debt, that’s not smart.

You need to get rid of the hole in the bucket. You’ll notice in the chart above, we still allocated 5% to the ‘GROW’ account. This is purely to get you used to investing right away.

You might have realized by now, I place a massive importance on habits and systems, instead of what’s most logical. Like we discussed – your logic and willpower will only take you so far. Until you get tired, a craving, a mindless moment, etc. Then logic and willpower go out the window! But systems and automation don’t rely on us, and that’s why they’re perfect!

Last word on conquering high-interest debt

If you have multiple credit cards, payday loans or nasty debts – choose the one with the lowest balance, and eradicate that first. Then move on to the next one. But wouldn’t it be logical to choose the one with the highest interest rate? Yes, it would be. But the ‘mental win’ of closing a debt account is euphoric, which will motivate you to crush the next debt.

Remember: habits > logic.

Once all your high-interest debt has been destroyed, close the checking account we opened for that purpose. Then use the first basic 1.0 infrastructure set up.

Running Your Personal Finances Like a Company

Next, let’s talk about running your personal finances like a fortune 500 company! Companies need to be able to audit their finances. Therefore, everything must be tracked. Every bank account and card is linked to software. Those transactions are then categorized and reconsiled. A large company might be marking their transactions into cataogries like cost of goods, marketing, software, salaries, and dozens more. However, on a personal or family level, your catagories will be very simple:

- Housing

- Utilities

- Food

- Health/Grooming

- Shopping

- Insurance

- Travel

- Entertainment

There may be a few more depending on your situation. But you certainly won’t have hundreds of categories. The key thing with taking back control of your personal finances, is that you must track your financial data. Remember the quote from Peter Drucker – “what gets measured, gets managed”.

The great news, is that it’s now a piece of cake to track and categorize your expenses.

You can use a simple apps like those from Mint or YNAB, connect your new bank accounts, and they will automaticlly start tracking and itemizing your expenses!

Set a monthly date, where you will sit down and go through your expenses, and categorize them. You can even set rules so that repeating expenses automatically get assigned a category. It really can’t get any easier (at least until the robots arrive!)

Your monthly ‘audit’ will give you the data you need to make decisions, optimize your money machine and more importantly – feel in control of your money.

While the money machine infrastructure we set up above does most of the heavy lifting (since it has a built-in budget), by categorizing our expenses, we can get more granular and see if there are some costs that no longer make sense for you.

This is how companies do it, and so should you. Because it works.

Mastering Purposeful Spending

Part of being in control of your finances is purposeful spending. Don’t let anyone tell you what’s important for you and what’s not – it’s your choice. Buying a takeaway coffee might seem ‘silly’ and a ‘waste of money’ for someone else, but that doesn’t mean it is for you. Going to the cinema as a family might seem ‘silly’ to another family, but it doesn’t mean it is for yours.

Now that you’ve got an amazing money machine set up, have full visibility on your spending through software, you’ll have the ability to take a good look at your habits and question some assumptions.

What’s really important to you?

Do you really need that fancy car? Having to categorize the repayment every month might make you think twice! Would you be just as happy with a good, reliable, economic car that does the same job?

Do your insurance products even make sense? Is it time to talk to an independent expert and re-assess the ‘essentials’?

Is it possible to batch-cook some lunch for the entire week, and avoid buying overpriced meals at the place next to your work?

Can you buy certain groceries in bulk online, and save a boatload of money?

Can you Airbnb one of your rooms for a couple years?

It’s time to question every assumption and get clear about what expenses are adding value to your life, and which ones are what I call ‘financial bloat’.

Thinking about how you spend, might mean that you end up spending more on things that truly bring you value, and cut out all the bloat.

Financial Minimalism

If you want to feel in control of your finances, grow your wealth, and feel happier – then applying a clean-out of your financial life might be one of the best things you ever do.

What do I mean by financial minimilism?

The easiest way to think about it, is to think about your financial ‘system’, and consider what parts make you feel overwhelmed.

Is it your 8 reward cards/programs you’ve signed up for? Get rid of them if they’re causing more overwhelm than what they’re worth. Cash them out or ‘redeem’ them, then get rid of them all.

If you’re getting started, and you want to take my advice on keeping things simple, and only adding complexity when it’s absolutely worth it – then remember this word:

Consolidation.

Consolidate any financial accounts, programs, cards, apps, and whatever else you have into as few moving parts as possible.

On the subject of minimalism, and while we’re doing a clean-out, it might be a good idea to actually sell random stuff around the house, and put that money straight into your ‘GROW’ account!

Setting Up and Feeding your Money Multiplier (Power of Investing)

Believe it or not, you’ve already done the hard work by the time you get to this stage. This is where you allow your money to work for you. Your dollars will be out there like good little robots, multiplying your wealth.

So what kind of investing is safest and most reliable?

As you know, investment options are never-ending.

You could pick and choose which stock you think will be the “the one”.

You could speculate about the next hot cryptocurrency.

You could give your money to a managed fund and let the ‘experts’ deal with it.

You could buy real estate.

You could buy government bonds.

You could find some youngsters building the next tech unicorn and fund them.

All these investment options above are viable and can make you a lot of money. When it comes to investing, there are always some factors to consider:

- Potential upside

- Timeline

- Risk

- Passive vs active

No matter what you choose, you will almost always be taking a hit on at least one of the factors above.

Imagine if someone told you there was an investment with 10,000% upside, it’s going to the moon within one month, there’s 0% risk, and it’s 100% passive. You would never believe it. Because opportunities like that simply don’t exist for the general public (as far as I know!)

However there is an investment that has these characteristics:

- Better upside than a high-interest bank account

- Reasonable growth timeline corresponding with overall economic growth

- Very low risk

- 100% passive

This investment is that of large, diversified index funds. The most popular index fund is the S&P 500. A collection of 500 of the biggest companies in the United States. An index fund tracks the performance of all the companies in it, therefore is passive in nature. Unlike managed funds, where they need full-time fund managers on staff, an index fund has very low fees.

The S&P 500 has averaged 8% growth since 1957. That’s far superior to what you would get leaving your money in a high-interest bank account.

Here are my top 3 recommendations for low-cost S&P 500 index funds.

- Vanguard 500 Index Fund – (VFIAX)

- Schwab S&P 500 Index Fund (SWPPX)

- Fidelity 500 Index Fund (FXAIX)

The primary ‘default’ method in the ‘money multiplier’ is to sign up for a stockbroker (like Fidelity), and either transfer the money from your ‘GROW’ account manually, or set up auto-investments (preferred method) so you don’t have to think about it.

NOTE: by investing in the stock market, your money will be subject to natural market dips and corrections. Don’t invest money that you will likely need to access within 24 months, because then you may need to sell your stocks at a loss – which I don’t need to tell you, is not ideal!

Assets vs Liabilities: Why Wealthy People Love Assets and Debt…

Two words: Appreciation & inflation.

These two words explain why wealthy people love using debt to buy assets.

The dollar’s inflation rate averages approx 2% – that’s what the Fed aims for by manipulating interest rates and money supply. That means that $1.00 today will be worth approximately $0.98 next year.

Understanding this is very important. Because it works both ways. On money you have in your possession. But also money that you owe!

Inflation is a bad thing for us when it comes to cash we have in a bank account. But believe or not, as long as we’re purchasing assets, it’s actually a good thing for money we owe.

Assets, generally speaking, appreciate (get more valuable) over time. While the value of money (fiat) goes down. Therefore the debt becomes more insignificant over time.

So wealthy people love buying assets with borrowed money. Again: assets go up in value, while debts go down in value over time (due to inflation).

NOTE: there are no guarantees any asset or investment will produce returns. You should always speak to a professional before buying assets, particularly when using leverage (debt).

So what’s the best asset to buy with debt?

While there are no concrete statistics in terms of the percentage of millionaires who used real estate to accumulate their wealth – you can rest assured, it is significant.

Real estate as a wealth-generating investing strategy is as tried and true as they come. Yes, there are many pitfalls, but if you make the right decisions – you can potentially rocket your net worth. Why? Because you are using leverage. You see, a 6% return may not sound very exciting, but when you’re talking about an asset like a home which is worth, for instance, $600,000 – all of a sudden, 6% of that doesn’t sound so bad ($36,000).

The great thing about real estate is that it’s versatile. You can wait for appreciation (natural growth), or you can manufacture it through renovations and/or sub division!

Overall, real estate is a great money multiplier once you’re ready for it. You need to have the deposit, and a solid emergency fund before you consider buying.

Optimization & Financial Steroids

We’ve covered a lot of topics in this guide. And while I’ve tried to keep it simple, I can’t deny – it can still be overwhelming to read this much information about money and investing.

This guide was designed to be followed step-by-step, so feel free to take it slow, start with the basic set up, and come back later for the rest.

However, for some of you, you’ve already set up your money machine, expense tracking, sold everything except your shoes, made your first index fund investment and you’re wondering – what’s next Joe?

Well, you simply add water – and a bit of steroids to your financial tree!

Starting a side hustle

Once you’ve set up a solid system, like the one above – there’s nothing left to do but feed it!

Starting a side hustle is one of the best ways to do this. You can take a look at my top recommended side hustles on this page. Even generating an extra $500 can make a huge difference, because that should go directly into your ‘GROW’ account, ready to be fed to the money multiplier machine.

Optimize your ‘Money Machine’

Once you have a couple of months worth of data, you’ll likely need to optimize your money machine a little. You may have underestimated some of your expenses or miscalculated your ability to live without entertainment! Whatever the case, you can re-crunch your numbers to get the auto-transfer amounts optimized. Keep a cool head, look at the data, and make decisions.

Look into manual investing

I talked up index fund investing above because it’s honestly the best choice for many people. However for those of you who are more ambitious, and unimpressed with a measly 8%, you may want to consider growth stock investing, crypto investing, real estate flipping/development, or even buying a managed business. I’ll be writing in detail on all of these, so keep a look out for new articles.

The End… and Your New Beginning…

I sincerely hope this guide has renewed your passion for money management! With enough time, you’ll feel so in control of your finances, it will turn into a game. I highly suggest reading my article on financial independence & FIRE, especially if you like a challenge! If you have any questions, please leave them in the comments section below, and I will add them to an FAQ section at the bottom of this guide. Happy money management!